Engineering and construction costs rose again in March, recording the seventeenth consecutive monthly increase, according to IHS Markit, now a part of S&P Global, and Procurement Executive Group (PEG). The headline IHS Markit PEG Engineering and Construction Cost Index increased from 75.3 in February to an index score of 85.5 in March, the highest figure for the index’s ten-year history. The subcontractor labor index rose 4.8 index points in March to 79.3 from 74.5 in February, while the sub-index for materials and equipment costs rose 12.6 index points to 88.2.

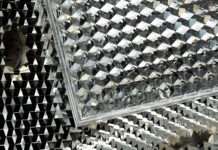

Shipping costs rose for the nineteenth consecutive month, with both routes from Asia and Europe to the United States reaching an index level of 90.0 in March. Many metals prices reached new price peaks in March as well. The structural steel sub-index rose from a reading of 70.8 in February to 79.2 in March. The sub-index for carbon steel pipe rose 20.8 sub-index points to 87.5. Every respondent noted price increases for transformers and electrical equipment, placing the index figure for both categories at 100. The sub-index for copper-based wire and cable prices also rose again from 79.2 in February to 95.5 in March.

“The most vital input to wire and cable production, copper, hit an all-time record high of $10,730 per metric ton on 7 March, in what we now regard as collateral damage from the turmoil in nickel trading,” said John Mothersole, pricing and purchasing director, S&P Global Market Intelligence. “Russia is a sizable copper producer, representing about four to five percent of global mine and refined production. While there may be a temporarily disruption as trade flows reorient in response to the Russian invasion of Ukraine, there is not likely to be a net loss in supply to the global market.”

The sub-index for current subcontractor labor costs came in at 79.3 in March, an increase from February’s index figure of 74.5. According to survey responses, labor costs continued to rise in all regions of the United States and Canada.

The six-month headline expectations for future construction costs index rose to 77.0 in March, as the index continues to signal respondents expect prices to continue increasing well into the third quarter of 2022. The six-month expectations index for materials and equipment came in at 76.0, 19.9 index points higher than last month’s figure. The six-month expectations index for sub-contractor labor declined 9.8 index points this month to 79.1 with respondents expecting labor costs to continue to rise in all regions of the United States and Canada.

The materials reported for shortages this month unsurprisingly referred mostly to electrical steel and electrical equipment components.

Read more at the original article here.

Related Articles:

Cost and Time Savings of Using 3D Printing to Fabricate Automotive Components