Wherever you go, money talks. And it has for a long time.

Sadly, though, money has been mum about its origins. For such a central element of our lives, money’s ancient roots and the reasons for its invention are unclear.

As cryptocurrencies such as Bitcoin multiply into a flock of digital apparitions, researchers are still battling over how and where money came to be. And some draw fascinating parallels between the latest, buzzworthy cryptocurrencies, which require only a virtual wallet, and a type of money developed by one Micronesian island community that wouldn’t fit in anyone’s wallet, pocket or purse.

When it comes to money’s origins, though, conflict reigns. Economists have held one view of money’s origins for hundreds of years. But a growing number of anthropologists and archaeologists, holding a revisionist view, say that economists’ standard story is bankrupt.

Economists and revisionists alike agree that an object defined as money works in four ways: First, it serves as a means for exchanging goods and services. Currency enables payment of debts. It represents a general measure of value, making it possible to calculate the prices of all sorts of items. And, finally, money can be stored as a wealth reserve.

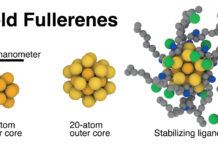

An early system of money invented on the Pacific Island of Yap has parallels to modern-day blockchain technology and bitcoin.

From there, the two groups split. Mainstream economists assume that bartering of goods and services inspired money’s invention. Anthropologists and archaeologists contend that early states invented currency as a means of debt payment.

“Much academic work assumes that [monetary systems] arose in nation-states within the last 200 to 400 years,” says sociocultural anthropologist Daniel Souleles of Copenhagen Business School in Frederiksberg. But financialized transactions and debt show up in lots of places much further back in time.

Recent research from the Americas adds new questions to the debate. These investigations suggest that money independently appeared for different reasons and assumed different tangible forms in many parts of the world, starting thousands of years ago.

Debt bet

Since the 1776 publication of Adam Smith’s The Wealth of Nations, a consensus among economists has held that people’s self-interested trading decisions automatically balance supply and demand with little or no need for government involvement. A natural human tendency to barter one product for another, say potatoes for pottery, led to the invention of money in ancient Eurasian states, economists hold.

That well-worn story gets money all wrong, anthropologists and archaeologists say. “Adam Smith based his ‘creation myth’ of financial systems on ignorance of what actually happened in the past,” says archaeologist Robert Rosenswig of the University at Albany in New York.

Early governments created money to pay off public works debts and to collect taxes, Rosenswig contends. Bartering had nothing to do with it. Instead, money grew out of older systems of credit and debt, which anthropologists have documented for more than a century. In small-scale societies, debts concern obligations to others. Among hunter-gatherer and farming groups, for example, daughters given away in marriage create debts that are partially repaid with goods known as bridewealth. Full repayment requires that the recipient of the first bride provide a bride in return. No cash needed.

Read more: Conflict reigns over the history and origins of money

thumbnail courtesy of sciencenews.org